House prices grew by 10.8% between April 2013 and 2014, according to the S&P/Case-Shiller 20-City Composite Home Price Index, which was less than the 12-month growth rate of 12.4% seen in March. Similarly, the Federal Housing Finance Agency’s Purchase-Only Index rose 6.0% compared to 6.4% in March. On a seasonally-adjusted monthly basis the 20-City Composite index increased by 0.2%, while the Purchase-Only index was virtually unchanged. Both indices show that annual house appreciation has slowed over the past five consecutive months ending in April and suggest the housing market may be returning to its long-run trend of growth.

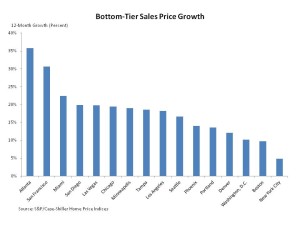

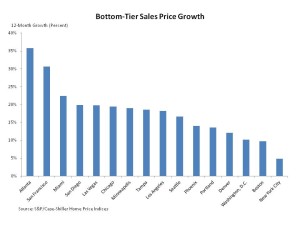

Among the 20 metro areas, Las Vegas experienced the largest annual gains (18.8%), followed by San Francisco (18.2%) and San Diego (15.3%). Meanwhile, cities experiencing the smallest increases include Cleveland (2.7%), Charlotte (4.4%) and New York City (5.4%). In addition, some areas are exhibiting large price gains for lower-priced homes as the chart below demonstrates. In April, Atlanta saw a 35.8% annual increase in homes under $153,000 and San Francisco saw homes under $496,200 rise 30.6%. In contrast, New York City saw an increase of 4.8% and Boston a 9.7% gain.