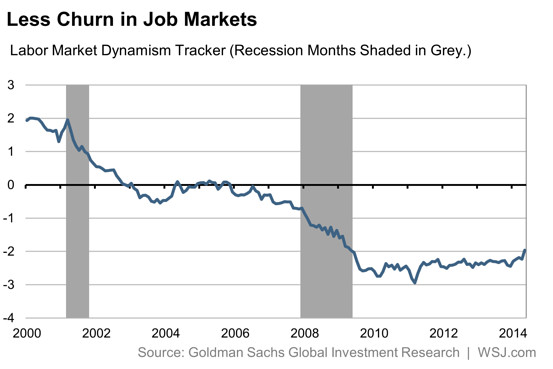

Companies are laying off far fewer workers, but the hiring rate has recovered only partly from the recession. People are quitting less often, and workers show a greater tendency to stay put. Although some of the reduced churn reflects structural effects, “the decline seems mostly cyclical in nature,” writes David Mericle, a U.S. economist at Goldman.

Does a less dynamic labor market matter if top-line job growth is doing well? Yes, the report says.

First, a more static labor market “is likely to see weaker wage and productivity growth.”

Workers may stay put in jobs that don’t use their skills to the best effect. That mismatch reduces an employee’s ability to negotiate pay raises and also reduces his or her productivity. In addition, the Goldman report notes other research showing a large share of an individual’s wage gains comes from switching employers.

“A labor market with little turnover is naturally more difficult to enter for those not currently employed,” Mr. Mericle writes.

According to Labor Department data, in this recovery, the longer a person is out of work, the lower the chances of finding a new job. In addition to the personal and government costs of long-term unemployment, a large number of permanently unemployed workers reduces the U.S. economy’s potential output.

Add that drag to weaker wage and productivity growth, and it’s easy to see why the Federal Reserve is concerned about labor-market churn.

via Fewer People Are Quitting Their Jobs, And Why That’s Not Good – Real Time Economics – WSJ.