Index funds don’t just outperform most actively managed mutual funds. They also make more money for investors.

And, no, I didn’t just repeat myself.

At issue here is the distinction between a fund’s total return and its dollar-weighted return. The total return is the standard performance number you see on fund-company websites and in fund prospectuses. It combines share-price changes and dividends to tell you how much you earned over, say, five years, assuming you invested at the start of the period and reinvested all distributions in additional shares, but otherwise never again bought or sold shares.

A dollar-weighted return, meanwhile, tells you how much the average investor made. Suppose a fund finished the year where it began, for a 0% total return, but during the year its share price rose sharply and then fell. If investors poured money into the fund after the sharp price gain, the average shareholder would have lost money, despite the fund’s 0% total return.

Indeed, mutual-fund investors have a reputation for buying funds after they have performed well and then selling in a panic when that hot performance turns cold. But here is the surprise: It seems investors behave more sensibly when they bypass actively managed funds, which seek to beat the market, and instead purchase index funds.

An index fund buys many or all of the securities that make up a market index, such as the S&P 500, in an effort to replicate the index’s performance. That has proved to be a winning strategy, because most actively managed funds lag behind the market, as their managers’ stock picks don’t perform well enough to overcome the drag from the funds’ expenses.

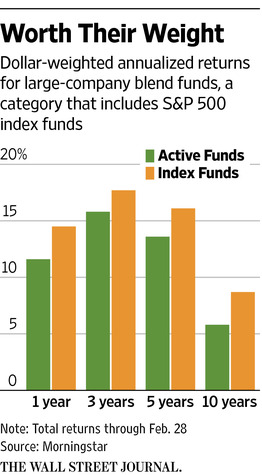

I asked Chicago investment-research firm Morningstar to analyze index funds and actively managed funds in 10 major stock-fund categories. The categories consist of all nine U.S. “style boxes,” such as large-company growth funds and midsize-value funds, plus the category that encompasses foreign-stock funds that buy large-company shares and use a blended investment style.

Morningstar looked at results for the one, three, five and 10 years through Feb. 28. It compared each category’s dollar-weighted return to the category’s total return. If the dollar-weighted return was higher, it suggests investors behaved sensibly, hanging tough in down markets and not chasing performance during good times.

So how sensible were investors? With 10 categories and four time periods, we have 40 readings. In 29 of those readings, the dollar-weighted result for index funds was above the average total return for those funds. But with actively managed funds, there were only nine instances when the dollar-weighted return beat the category’s average total return.

The 10-year results were especially telling, because they include the 2007-09 bear market—a time when even veteran investors made panicky decisions. For six of the 10 categories, the 10-year dollar-weighted returns for index funds were better than the average total return for those funds. What about active funds? There wasn’t a single instance.

“I think there’s genuinely good behavior with index funds,” says Morningstar’s John Rekenthaler, a vice president of research. “But there’s also a question of timing.”

He notes that, after the rotten performance of the 2007-09 bear market, many investors swapped out of active funds and into index funds. Thanks to that gush of money into index funds, the rally of the past six years receives added credit when calculating index funds’ dollar-weighted results.

But this doesn’t explain the whole story. Suppose we take the past 10 years and look just at the first half, which includes the 2007-09 bear market and the first year of the subsequent rebound. During this five-year stretch, index funds’ dollar-weighted results beat their total return in eight of the 10 categories, while active-fund investors managed this feat in just two categories.

Why have index-fund investors behaved more sensibly? It is tempting to argue that indexers are smarter. Instead of pursuing the slim possibility of market-beating returns with active funds, they realize the rational strategy is to index.

But I suspect it is less about greater intelligence and more about greater conviction. When you buy an index fund, your only worry is the market’s performance. But when you buy an active fund, you have to worry about both the market’s direction and your fund’s performance relative to the market. That double uncertainty may make investors more jumpy—and thus more likely to buy and sell at the wrong time.

One caveat: Morningstar’s results are for mutual funds only, and hence they don’t include exchange-traded index funds. Mr. Rekenthaler says calculating dollar-weighted results for ETFs wouldn’t tell you very much, because the flows in and out of these funds often reflect institutional investors buying short-term market exposure or arbitraging price differences between ETFs and other investments.

In addition, investors sometimes sell ETFs short, in a bet that prices will fall—something you can’t do with mutual funds. This shorting wouldn’t be reflected in ETFs’ dollar-weighted results.

Jonathan Clements is the author of the “Jonathan Clements Money Guide 2015.” Email:ClementsMoney@gmail.com