Fewer People Are Quitting Their Jobs, And Why That’s Not Good – Real Time Economics – WSJ

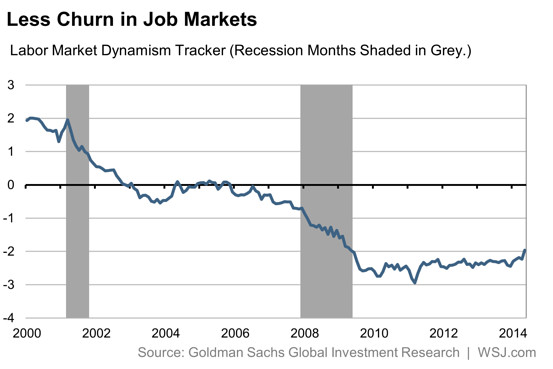

Companies are laying off far fewer workers, but the hiring rate has recovered only partly from the recession. People are quitting less often, and workers show a greater tendency to stay put. Although some of the reduced churn reflects structural effects, “the decline seems mostly cyclical in nature,” writes David Mericle, a U.S. economist at Goldman. […]

Can An Employer Implement A Social Media Policy?

It’s a complicated, fact-intensive inquiry in every case, but the bottom line is that employers can implement a policy so long as it doesn’t stymie the ability of employees to engage in protected, concerted activity about their conditions of employment. In other words, you can so long as it doesn’t run contrary to labor laws […]

The adjusted net hourly wage for an internal medicine physician is $34.46?

A school teacher (or most professionals for that matter) will now over a life time earns almost more than an internal medicine physician? A great article on the current economics of medicine and why past earning capacity is not reflective of the future. I agree that the face of medicine has changed and thus one […]

50 Signs You Need to Start Your Own Business | Entrepreneur.com

If you’re sitting at your desk, daydreaming about starting your own business, this is the article for you. You already know that launching a company can be an intimidating process requiring tons of hard work. But the question has been lingering with you day and night. Maybe you’re just unhappy with your current position. Perhaps you’ve always dreamed of […]

Why Taking Early Social Security Benefits May Work For You – WSJ

According to conventional wisdom, everyone should strive to defer their Social Security benefits for as long as possible. And for most investors–those who will rely on Social Security to meet their monthly needs in retirement–continuing work until 70 and letting those benefits grow, is the right decision. For clients who have done very well building […]

Credit scores might soon reflect rent payments | The Columbus Dispatch

Two of the national bureaus — Experian and TransUnion — have begun incorporating verified rental-payment data into credit files where it can be included in the computation of consumers’ scores when they apply for a mortgage. via Credit scores might soon reflect rent payments | The Columbus Dispatch.

Credit-Card Lenders Pursue Riskier Borrowers

Lenders are courting risky credit-card borrowers more aggressively than they have since the financial crisis in a bid to jolt revenue in a period of sluggish growth and tight regulation. Banks and other lenders issued 3.7 million credit cards to so-called subprime borrowers during the first quarter, a 39% jump from a […]

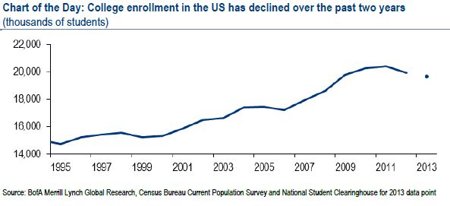

Fewer head for college–which might be a good thing | Daily Ticker – Yahoo Finance

But fewer people might be going to college for the right reasons: There are better opportunities elsewhere. “When the economy stinks, people often try to hide in a classroom,” says economist Ryan Sweet of Moody’s Analytics. “The number of job openings now is higher than in recent memory. So the decline in college enrollment is […]

New Ruling: Debt Collectors Could Be Fined $1,500 Every Time They Call

June 18, 2014 by Gerri Detweiler Consumers who don’t want to be contacted by debt collectors on their cellphones may have a powerful new ruling on their side. It may not only help them stop these calls, but it may increase the chances that they can collect damages of $500 to $1,500 per call. In a recent […]