Using Self-Directed IRA (Roth IRA) For Real Estate Investing

Boosting IRA gains by diversifying into real estate Financial planner says it offers attractive benefits Kim Crompton Spokane Journal of Business – March 12th, 2015 -—Kim Crompton Spokane-based financial planner and real estate professional David L. Baker says investing in real estate via a self-directed Roth IRA can provide an income stream that doesn’t deplete […]

A Washington Borrower May Stop A Non-Judicial Foreclosure Of Residential Property If The Loan Is Usurious

TRUDY M. DAVIS, a single person, Appellant, v. THE BLACKSTONE CORPORATION, successor trustee; and MICHAEL E. MENASHE, whose marital status is unknown, Respondents. No. 71090-7-I.Court of Appeals of Washington, Division One. Filed: March 2, 2015.Robert Michael Bartlett, Cook & Bartlett, 3300 W. McGraw St Ste 230, Seattle, WA, 98199-3246; Diana Suzanne Hill, Cook & Bartlett, […]

Judge says man can’t smoke in his own home due to neighbor’s 2nd-hand smoke concerns

Judge says man can’t smoke in his own home due to neighbor’s 2nd-hand smoke concerns. http://www.abajournal.com/mobile/article/judge_says_man_cant_smoke_in_his_own_home_due_to_neighbors_concern_about_2n/

Renter’s Insurance

If you have renter’s insurance, you’re in the minority. According to a recent study from insuranceQuotes.com, 6 in 10 Americans don’t have this form of coverage. Take a moment to pat yourself on the back—having any renter’s insurance is a smart choice. But is it possible to have too much of a good thing? http://oak.ctx.ly/r/2m9ro

Top 10 Reasons You Are Going To Be Audited This Year

by Jesse Campbell on March 18, 2013 No one wants to go through an audit from the IRS. It’s time consuming, stressful and could very well end with you paying steeps fines or even facing jail time. It’s also very unlikely to happen to you. In 2011, the IRS audited 1.6 million individual returns, which […]

Borrower Cannot Enforce A HAMP Trial Payment Plan (TPP) If The Borrower Does Not Qualify For The Modification. No FDCPA Claim For Wrongful Foreclosure

DO NOT CITE. SEE GR 14.1(a).Court of Appeals Division III State of Washington Opinion Information Sheet Docket Number: 32011-1 Title of Case: Christiania Trust v. Steven M. Miller, et ux et al File Date: 03/05/2015 SOURCE OF APPEAL —————- Appeal from Spokane Superior Court Docket No: 12-2-03495-2 Judgment or order under review Date filed: 09/20/2013 […]

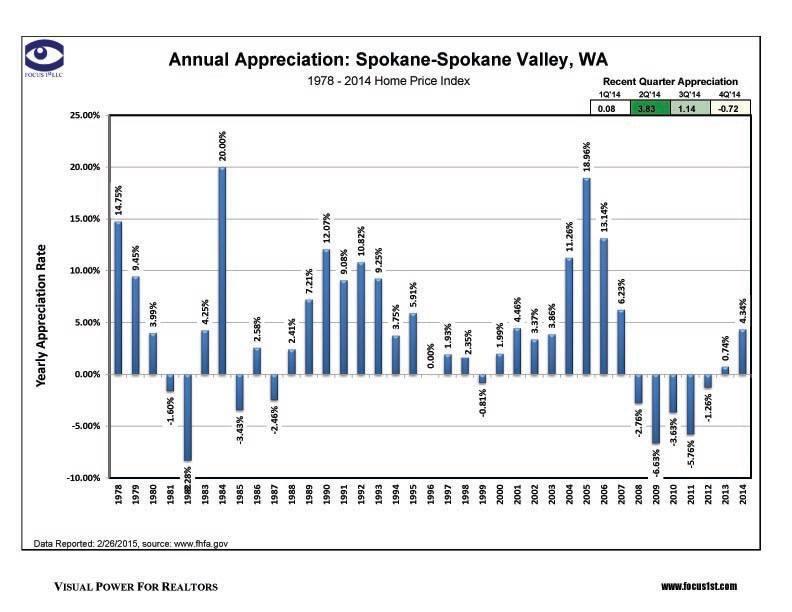

6 Critical ‘Musts’ For Every Real Estate Investor

If you want your money to work for you, follow these rules Investment in any industry isn’t easy, and real estate investment can be particularly challenging. Here are six things you need to get a handle on before you start pouring money into a real estate investment. 1. You must know your market. When I first […]

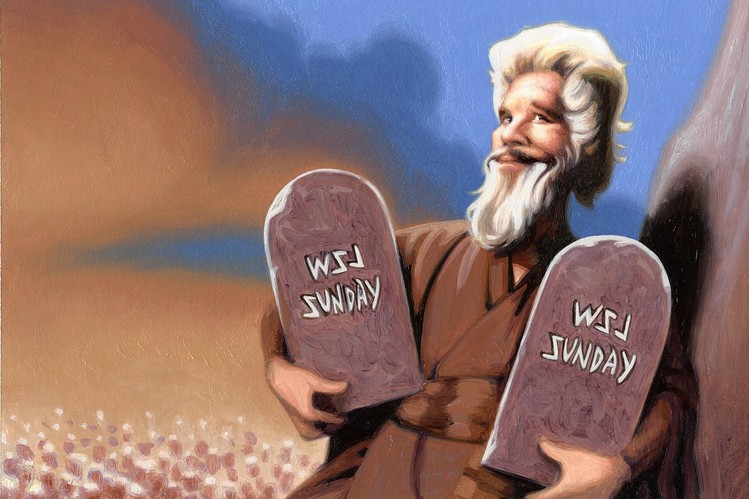

Simple, Bedrock Rules on Personal Finance – (Brett Arends) Wall St Journal

Smart money moves aren’t more complicated than you think. They’re simpler. Cut through all the jargon and pontificating and technical stuff, and everything you really need to know about personal finance fits into less than 1,000 words—no more than three to four minutes. Ignore economic and financial forecasts. Their purpose is to keep forecasters employed. […]

IRS Audit Red Flags-Claiming Rental Losses – Kiplinger

Claiming Rental Losses Normally, the passive loss rules prevent the deduction of rental real estate losses. But there are two important exceptions. If you actively participate in the renting of your property, you can deduct up to $25,000 of loss against your other income. But this $25,000 allowance phases out as adjusted gross income exceeds […]