In 2013 – 56% of Washington State Homebuyers Were First-Time Buyers

New data show that first-time home buyers aren’t playing as big a role in the mortgage market as they did a few years ago, when prices were lower and a big tax credit fueled a surge of sales. The research from the Federal Housing Finance Agency looks at the share of mortgages taken out by […]

Lenders could be held responsible for upkeep of foreclosed Spokane homes | KREM.com Spokane

by RYAN SIMMS & KREM.com Posted on August 16, 2014 at 9:19 AM SPOKANE, Wash. — A solution is in the works in Spokane to help get rid of foreclosed homes that have become eyesores. In Spokane, there are more than 200 properties that have been abandoned and are turning in to hotspots for crime. […]

5 Reasons to Hire a Real Estate Professional

Whether you are buying or selling a home, it can be quite an adventurous journey. The 5 Reasons you need a Real Estate Professional in your corner haven’t changed, but have rather been strengthened in recent months due to the projections of higher mortgage interest rates and home prices as the market continues to recover. […]

Top 10 ways to strengthen your purchase offer and beat out competing buyers | Inman News

Top 10 ways to strengthen your purchase offer and beat out competing buyers Going above the asking price doesn’t always sweeten the deal This post by real estate agent Janna Scharf, of Keller Williams Realty Coeur d’Alene, was originally posted on ActiveRain. I just finished up with my fortunate seller client who had the difficult […]

FICO will now stop including in its FICO credit-score calculations any record of a consumer failing to pay a bill if the bill has been paid or settled with a collection agency

Changes Could Lead to More Bank Lending, Easier Credit for Some Consumers By ANNAMARIA ANDRIOTIS – Wall Street Journal Updated Aug. 7, 2014 7:54 p.m. ET Fair Isaac Corp. said Thursday that it will stop including in its FICO credit-score calculations any record of a consumer failing to pay a bill if the […]

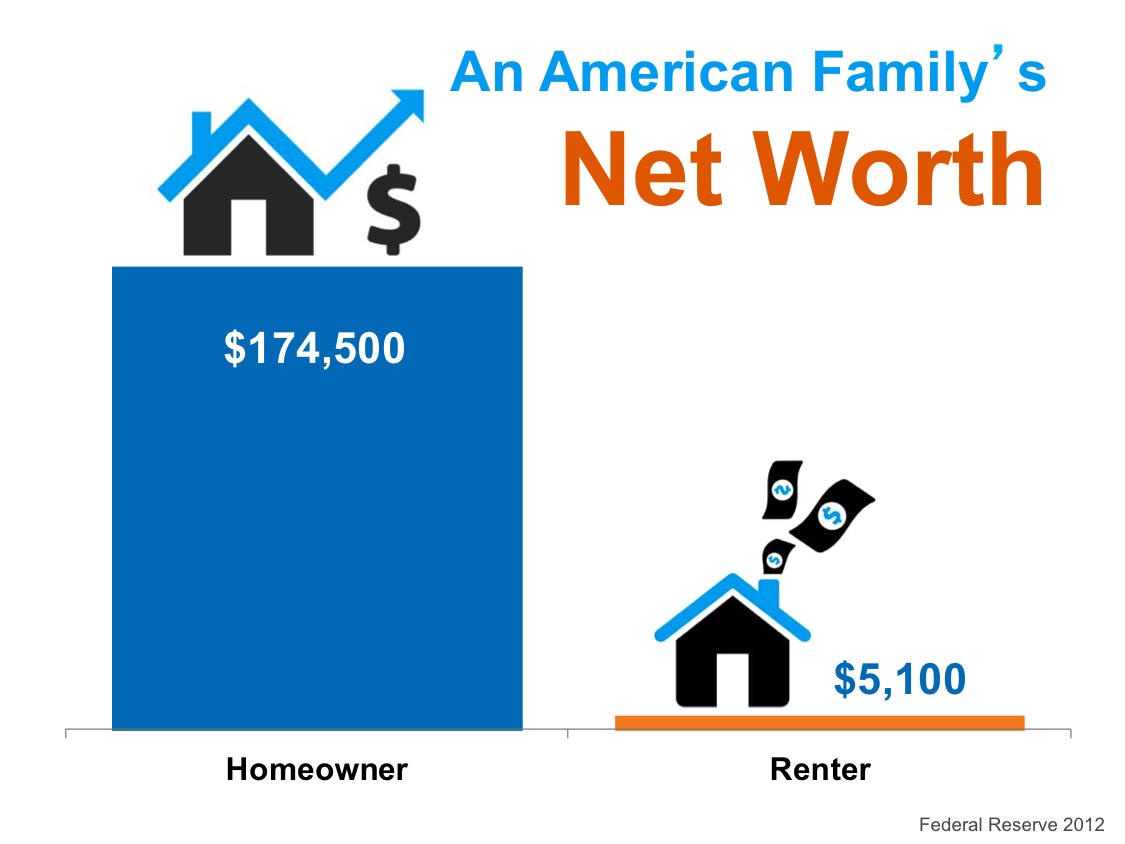

An American Family’s Net Worth – Homeownership Matters

A recent Federal Reserve report stated that the average American family has a net worth of $77,300. Of that net worth (61.4%) or $47,500 of it is in home equity. A homeowner’s net worth is over thirty times greater than that of a renter. The average homeowner has a net worth of $174,500 while the […]

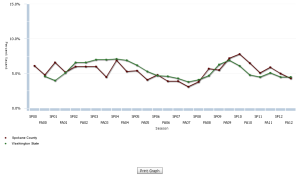

Spokane County Overall Apartment Vacancy Rate

This indicator measures the availability of apartment housing. The rate of apartment vacancies is due to several forces: changes in the supply of apartments, changes in the number of people seeking apartments, as well as a “frictional” level of empty apartments due to a timing gap between move-outs and move-ins. The apartment […]

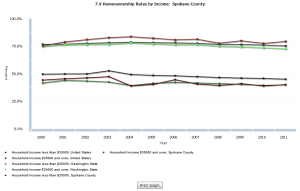

Spokane County Homeownership Rates by Income

Why is this important? How income levels affect rates of home ownership is an indicator of housing affordability and security within Spokane County. For most U.S. families, the home is the greatest asset in their portfolio. A recent study commissioned by the Consumer Federation of America and Fannie Mae concluded that homeownership is the main […]

In the first quarter of 2014, 4.42% of Washington mortgages were 60 or more days delinquent, and servicers had begun 4,181 foreclosure starts.

Data recently released shows that the number of delinquencies and foreclosure starts in Washington State is continuing to decline as the economy improves and Washingtonians enter repayment, modification, and refinance programs offered by the mortgage servicers. Washington is below the national average in terms of delinquencies, and the number of completed foreclosures in Washington dropped […]