Washington Court – Bank Wins Even If Bank Allegedly Told A Homeowner To Stop Making Payments On Their Home Loan In Order To Get A Loan Modification

Fairly routine decision. No surprises here. ANICE GEARY (Formerly Known as Valli), Appellant, v. ING BANK, FSB, a Delaware corporation; AURORA LOAN SERVICES LLC, a Washington Limited Liability Company; QUALITY LOAN SERVICE CORPORATION OF WASHINGTON, a Washington Corporation; ONE OR MORE INDIVIDUALS OR ENTITIES YET UNKNOWN, Respondents. ING BANK, FSB, a Delaware corporation, […]

When Can I Get A New Loan And When Is A Foreclosure Removed from Your Credit Report

FHA Fannie Mae Freddie Mac Foreclosure •3-year wait. •7-year wait from the completed foreclosure sale date. •3-year wait if borrower can show extenuating circumstances (additional underwriting requirements apply for 4 years after 3-year waiting period). •7-year wait for a second home, investment opportunity, or cash-out refinancing. •5-year wait from the completed foreclosure sale date. […]

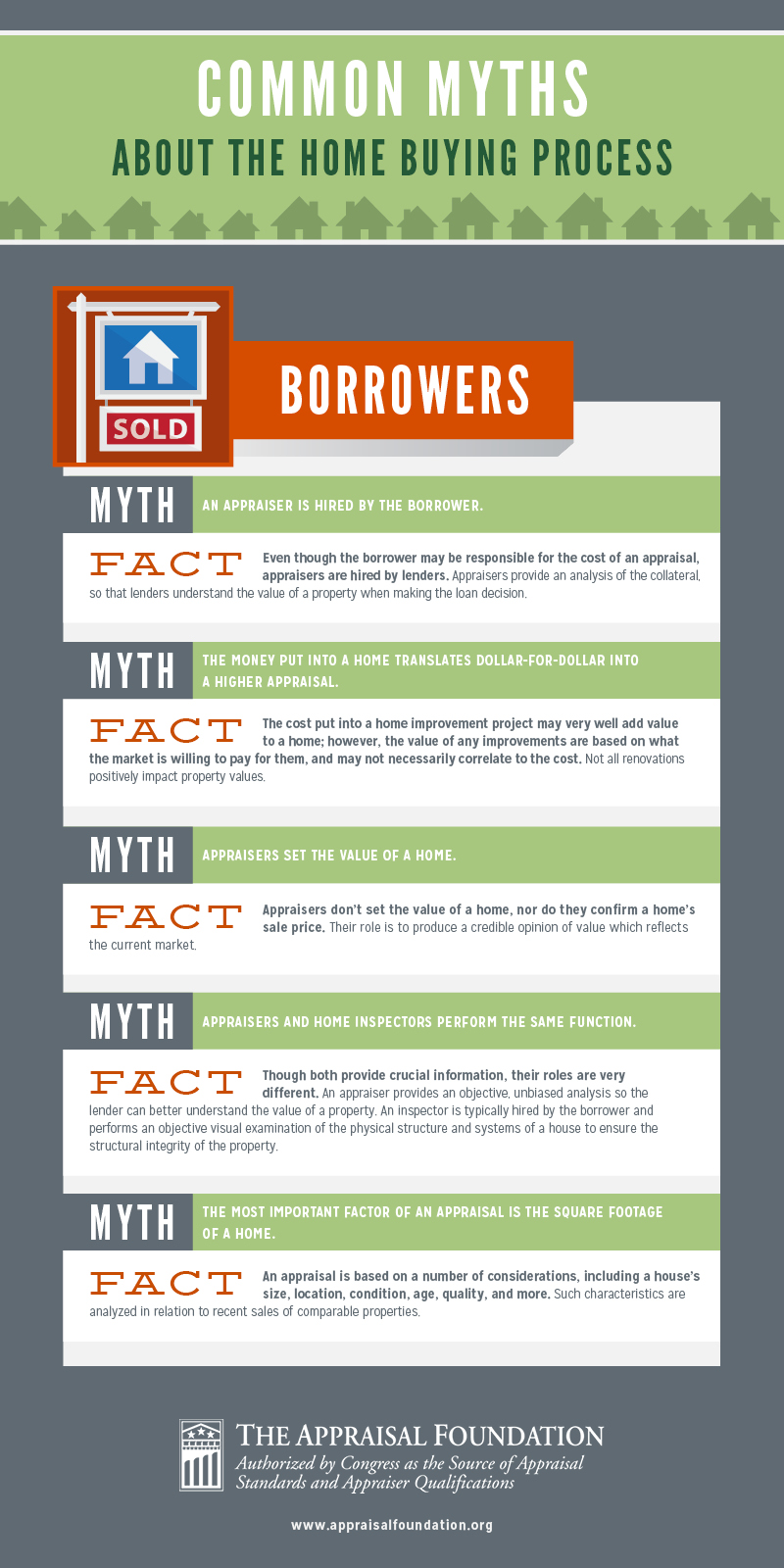

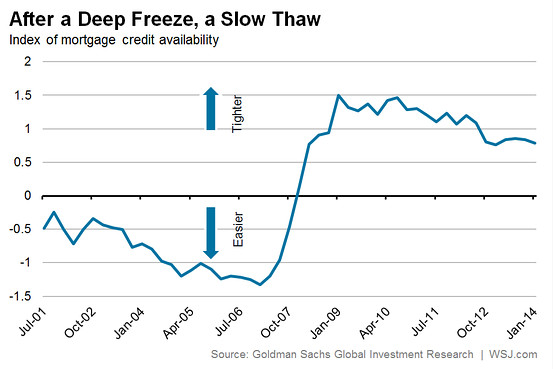

Standards are Tighter, Sure. But is It Really That Hard to Get A Mortgage?

It has become a common refrain: “It’s too hard to get a mortgage.” But is it true? An analysis from economists at Goldman Sachs GS -0.32% tries to shed some light on the question by measuring credit availability along several different dimensions, including common underwriting measures such as credit scores and loan-to-value ratios. The analysis also […]

Many homeowners with loan mods face rate increases – LA Times

Beginning this year, those whose loan terms were modified so that the interest rate dropped to as low as 2% will have to deal with higher rates that could, in some cases, drive the monthly payment as much as $1,724 higher. Why? Because “permanent” interest rate reductions under the government’s Home Affordable Modification Program were […]

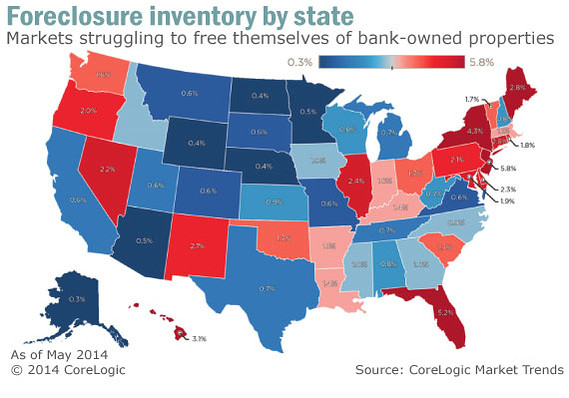

5 states with the most (and fewest) foreclosures

The five states with the highest foreclosure inventory in May were New Jersey (5.8% of all mortgaged homes), Florida (5.2%), New York (4.3%), Hawaii (3.1%) and Maine (2.8%). The five states with the lowest foreclosure inventory were Alaska (0.3%), Nebraska (0.4%), North Dakota (0.4%), Wyoming (0.4%) and Minnesota (0.5%) via 5 states with the most […]

RealtyTrac Ranks Best Overall Markets for Buying Residential Rentals and Renting to Boomers, Millennials

RealtyTrac, the nation’s leading source for comprehensive housing data, today released its Q2 2014 Residential Property Rental Report, which ranks the best markets for buying residential rental properties along with the best markets for renting to baby boomers and the best markets for renting to millennials. For the report RealtyTrac analyzed median sales prices for […]