September 27, 2014, 3:10 PM ET

SHARE:MORE EmailPrint

With the economy growing in fits and starts, an increase in “doubled-up” homes isn’t just young adults moving into their parents’ basements, according to a recent economic research note.

The number of in-laws and nonrelatives added to family households picked up last year, housing economist Thomas Lawler wrote in a Friday note.

“There was a substantial increase in the ‘doubling-up’ (or more) of households not attributable to ‘young adults’ moving back to their parents’ home,” he wrote.

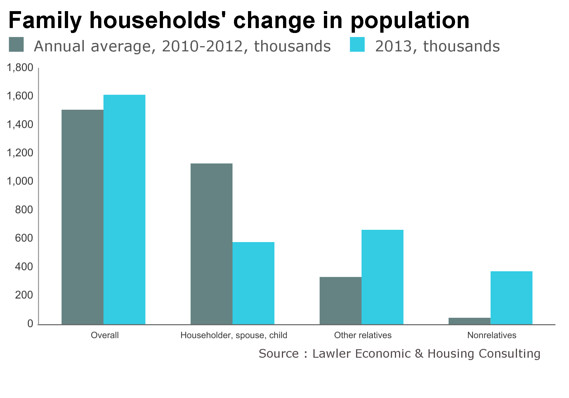

Crunching government data, Lawler found that in 2013, the population of family households (these are homes that contain families and may include other individuals) added 577,000 householders, spouses and children — down 49% from an average annual increase of 1.1 million between 2010 and 2012. Meanwhile, the number of in-laws and other relatives added to family homes hit 663,000 in 2013, double the recent average, and non-relatives rose more than 700% to 372,000.

Here are a few other trends worth watching:

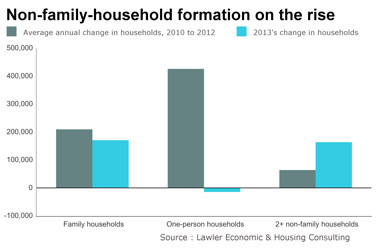

About 164,000 non-family households with at least two people were formed last year, up from average annual growth of 65,000 between 2010 and 2012.

There was a contraction of 14,000 last year in the number of one-person households, compared with average annual growth of 426,000 in recent years.

There was a gain of 171,000 family households last year, compared with an average increase of 210,000 in prior years.

Lawler is trying to figure out what’s behind the increase in doubling up, and said he’ll present those findings soon. It’s a trend that could get in the way of the housing market’s recovery. More doubled-up homes means fewer households are being formed and that home sales may not see a substantial jump higher anytime soon.

Recent data show that the sales pace of existing home – the majority of the market – fell in August for the first drop in five months, and was down more than 5% from the year-earlier period. Meanwhile, sales of new single-family homes surged last month, but related data show that builders are increasingly focused on constructing apartments, a trend that will slice housing’s contribution to gross domestic product.

Some economic factors have improved over the past year for home buyers and could lead to faster household formation. Job-growth trends are on the rise and home-price acceleration has cooled down.

But unattainable credit remains as one of the most durable and difficult challenges facing the housing market. In the wake of the financial crisis, lenders erected strict standards for would-be mortgage borrowers. While there’s been some easing in access, it’ still too tough for many families to get a loan, economists agree. Lenders are worried about the financial and legal risks for writing new mortgages.

–Ruth Mantell