How to Keep Your Inheritance in a Divorce

Strategies Include Saving Documentation and Maintaining Separate Accounts

MATTHEW HOLLISTER

By NEIL PARMAR

Nov. 9, 2014 4:45 p.m. ET

For the happily wed, marriage is often about sharing everything—including generous gifts bestowed by parents or grandparents.

But when a relationship ends in divorce, that perspective can change dramatically. At that point, however, it may be too late to keep inherited assets such as vacation homes, rare collections and other gifts away from a former partner, even if those assets were never intended to go to that person.

What is considered separate versus marital property can vary, depending on the state in which a couples lives. So-called kitchen-sink states such as Vermont, Michigan, Massachusetts and Connecticut, for example, don’t typically distinguish between separate and marital property.

“You may be able to walk away with that ring your grandmother gave you, but the value of the asset will be considered in the division of property,” says Lori Lustberg, a Shelburne, Vt.-based lawyer and certified divorce financial analyst.

While the financial outcome of a divorce may boil down to where you live, there are things you can do to help sway the outcome, especially when it comes to inheritances, experts say. Here is a look at a few strategies:

Negotiate a Prenup

While not always airtight, prenuptial and postnuptial agreements can help shield assets such as an inherited business, money, property or a rare art collection should a couple end up in divorce court. Depending on state law, a prenup or postnup can state that in the event of a divorce, each spouse will forgo his or her rights to any inheritance or major gift given to the other partner before or during the marriage.

While many perceive contractual agreements to be unromantic, they “work as intended,” says David Reischer, an attorney and chief operations officer at LegalAdvice.com, who signed a prenup with his wife to protect his inherited stamp collection.

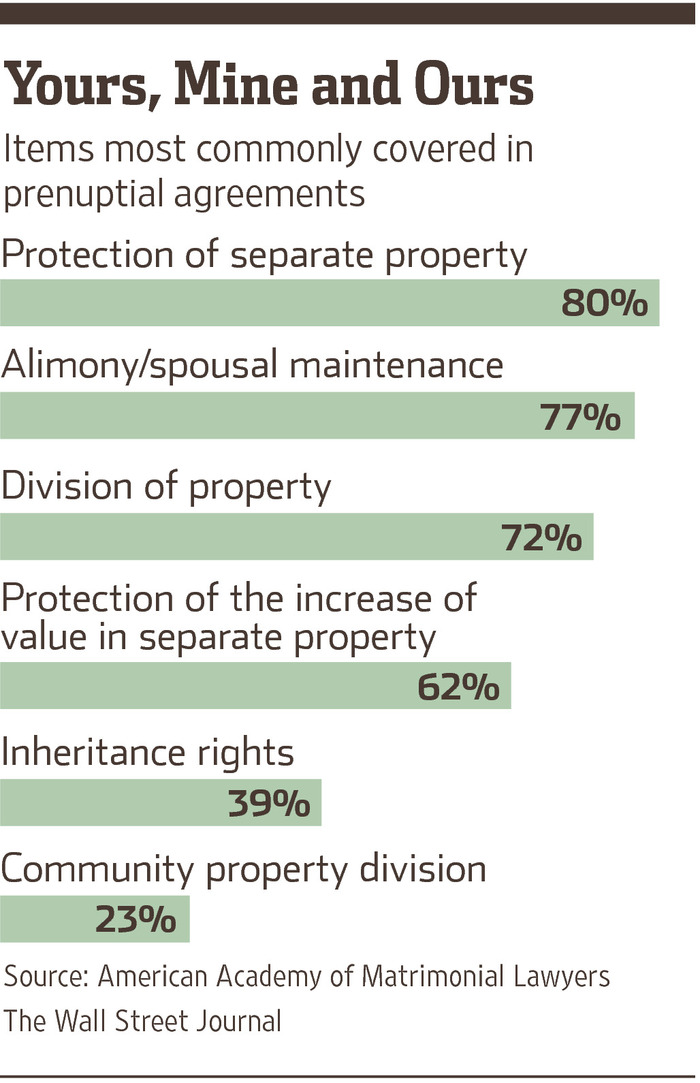

Couples may be getting more savvy about protecting what is rightfully theirs, according to attorneys. In 2013, 63% of members surveyed by the American Academy of Matrimonial Lawyers reported seeing an increase in prenuptial agreements during the previous three years.

Billy Bauer of Manhattan plans to go that route. He says he wants to marry his girlfriend one day—but only if she signs a prenup.

The 22-year-old’s biggest concern is protecting the future equity and voting stakes in his family’s 40-year-old business, Royce Leather, which he says generates more than $4.5 million in annual revenue and which he anticipates inheriting, along with his brother, after their parents pass away.

“I have to be as pragmatic as possible,” says Mr. Bauer.

Save Documentation

People should keep any paperwork that shows an inheritance was intended only for one partner.

“One of the arguments we see in Minnesota is if there is a gift received during marriage then the person who wants it back has to show it was a gift to them alone,” says Michael Boulette, a family-law attorney and adjunct professor in Minneapolis.

A copy of someone’s gift-tax return is especially useful for this purpose, as it includes a section where the donor can specify who the individual beneficiary was and how much that beneficiary was given. A letter from the donor that explains for whom the funds were intended or even a wedding card addressed to just one person also may help, some experts say.

“Every state is different [but] the more you have to show, the better your claim,” says Lisa C. Decker, a certified divorce financial analyst and chief executive of the Atlanta-based consultancy Divorce Money Matters. “If you do get anything in writing, put it in a safe place—with your attorney, your financial adviser, a relative or in a safe-deposit box. Nobody wants to think in 20 to 30 years they’ll need this stuff but it can happen,” she says.

Maintain Separate Accounts

Couples shouldn’t commingle inherited money or other assets in an account that also includes the other spouse’s funds. Instead, they should put it in a separate bank or investment account.

“If it’s separate then you avoid arguments unless it was gifted to the other spouse, as well,” says Mr. Boulette.

Ms. Decker says she has a divorce case where the husband and wife say they each received separate inheritances during their marriage, but that they put the funds in the same account and lost any paperwork about who was given what. In all likelihood, she says, they are going to have to split the money 50/50.

Of course, if a beneficiary spends an inheritance while married, in most cases it will be considered gone. “You don’t get reimbursed on divorce because you spent a gift from your grandparents on a wonderful vacation or to pay down debt,” Mr. Boulette says.

Rely on Trusts

Russell Redenbaugh, the San Francisco-based founder of Kairos Capital Advisors, says if he were to ever give a home to one of his children as a wedding present he would likely do it via a trust, which would include certain provisions to stop any assets from going to his child’s ex in the event of divorce. “That would prevent it from becoming marital property,” says Mr. Redenbaugh, who has already used trusts to protect other assets for his children.

A trust can be as broad or specific as someone wants, says Catherine Seeber, a senior financial adviser at Wescott Financial Advisory Group. In addition to property, trusts can be used to pass down a financial inheritance.

A trust is usually slightly more expensive than just gifting money, Mr. Redenbaugh says, and it may involve paying a fee to a person or firm to oversee it. But, he says, a simple trust document can be drafted in less than an hour.

Keep Titles in One Name

In the absence of a prenuptial agreement, the best way to protect separately owned property such as a vacation home bought and paid for before a marriage is to avoid adding a partner’s name to the deed, experts say.

They recommend using the same strategy if a spouse receives a financial inheritance specifically to buy a second home or investment property during a marriage.

Keep in mind that the way in which the property is used can change its classification in community-property states such as Arizona, California, Nevada, Washington and Texas. For example, if an inheritance is spent on a home that supports both spouses, it becomes marital property and may be used when negotiating equitable financial settlements, says Ms. Seeber.

Refinancing a mortgage and adding a spouse’s name to the deed at that time, or completing major renovations with funds that were jointly earned by a couple, could jeopardize full ownership of a home, experts warn. “All of that can cause house claims to fluctuate,” says Mr. Boulette. As such, the titled owner should cover all renovation and refinancing cost and save documentation that proves it.

Similarly, if a gifted vehicle holds considerable value, as some vintage models do, the beneficiary should make sure only his or her name is on the registration and that they, not a spouse, are the primary driver.

Mr. Parmar is writer in Toronto. He can be reached at [email protected].

via How to Keep an Inheritance From Going to a Spouse During Divorce – WSJ.