If Dave Camp gets his way, the standard deduction is going to get a lot bigger. Apparently that is a good thing. “Right now, more than a third of all Americans are forced to itemize their deductions to ensure they pay the lowest possible tax bill,” explained the Michigan Republican and House Ways and Means Committee chair. But under the Camp plan, 95 percent of taxpayers would be able to maximize their tax savings by simply claiming a new, much larger standard deduction.

What’s not to like?

Well, if you’re a charity, quite a bit. As John Buckley pointed out in Tax Notes (Tax Notes, Mar. 10, 2014, p. 1103 ), the Camp legislation would effectively repeal the charitable contribution deduction for all but a small slice of the taxpaying public (along with the mortgage interest deduction). Some people consider that a feature, not a bug. But most of those people aren’t running charities.

Camp shares his fondness for the standard deduction with his elected predecessors on Capitol Hill. In general, Congress has valued the provision for the simplicity it brings to the tax system.1 But charities have been uneasy with the standard deduction. They have fretted for decades over its tendency to reduce the incentive to give. And they have campaigned, with only fleeting success, to make the charitable contribution available to non-itemizers.

The tension between congressional lawmakers and charity lobbyists was particularly evident at the moment of the standard deduction’s creation.2 First added to the tax system in 1944, the provision immediately drew fire from charities (and especially from churches). Notably, those critics did not confine their attacks to the standard deduction’s presumed effect on the charities’ bottom line; they also decried it as a moral affront and political threat to the nation.

The standard deduction’s creation was a function of broader trends in federal taxation, especially the transformation of the individual income tax from a narrow levy on the rich to a broad tax on the middle class.3 With millions of new — and inexperienced — taxpayers joining the tax rolls for the first time, political leaders were keenly interested in smoothing the transition. Then, as now, simplification was all the rage.

“I think we ought not to take into the income tax system millions of new taxpayers with small incomes without simplifying the way in which their tax is computed,” declared Treasury Secretary Henry Morgenthau Jr. in 1941 testimony to the Senate Finance Committee.4 John Q. Taxpayer was already getting frustrated. “When he started to fill out his return . . . he may have been full of patriotic enthusiasm to pay his share toward the defense program, but by the time he has finished his last computation his cheerfulness may well have collapsed under the strain,”5Morgenthau said.

As a remedy, Morgenthau suggested a new, streamlined tax form for taxpayers with modest incomes and uncomplicated financial lives. The new form was designed to be radically simpler than existing forms. Morgenthau said, “We think it would be possible for a man to make out his income-tax statement in about 5 minutes without the help of anybody other than maybe the postmaster or some representative of the Treasury, without having to hire a lawyer and an accountant, and it would make the people a great deal happier about it, and it would take care of about 90 percent of the income-tax people that way.”6

A noble aspiration, but ultimately an unattainable one. While lawmakers did adopt a simplified tax form in 1941, the reform did little to slake the popular thirst for simplification. Indeed, the ink was hardly dry on the new Form 1040A when lawmakers began casting about for more ways to ease the filing process.

In 1943 lawmakers introduced withholding partly as a means to speed the collection of tax revenue, but also as a way to make the filing process less painful for taxpayers. Indeed, the two motives were inextricably linked.

Withholding was one of the great success stories of wartime policymaking, but it created some problems, especially for charities. Lobbyists for the nonprofit sector insisted that withholding was hurting donations, as Americans struggled to make gifts from shrunken paychecks. As first introduced, withholding was relatively inflexible, with only a limited capacity to adjust tax payments to individual circumstances (including a taxpayer’s expected donations). According to nonprofit lobbyists, that inflexibility caused a notable drop in charitable contributions immediately after the introduction of withholding.

As a remedy, charities proposed a “pay as you go” tax credit for charitable contributions. Under their plan, taxpayers would be allowed to adjust their withholding to account for expected contributions over the course of the year.7

Lawmakers were all ears, listening sympathetically to the plight of charity witnesses as they paraded through committee rooms. But Congress did not act — at least not as the charities had hoped. Congressional leaders were actually far more worried about tax complexity than they were about a modest decline in charitable giving.

To make the income tax simpler for millions of new taxpayers, lawmakers established a new “standard deduction,” set at 10 percent of adjusted gross income up to a maximum of $500 for single taxpayers or $1,000 for married taxpayers. Champions said the innovation would allow for “taxation without irritation.”8

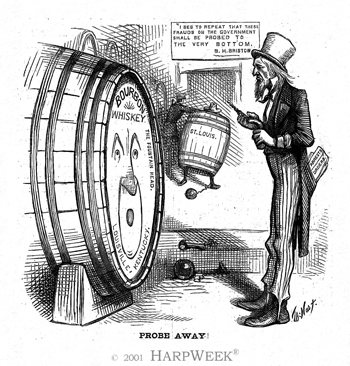

Charities were not happy.9 In fact, churches and other nonprofits treated it as an existential threat. In early 1944, representatives from a variety of institutions formed a new Council on Taxes and Philanthropy to lobby on behalf of the existing charity deduction. They contended that withholding was bad enough, having “jeopardized tax-exempt gifts to churches, colleges, hospitals and other philanthropic institutions.”10 The standard deduction promised to be much, much worse.

The council endorsed a plan to restore the special tax deductibility of charitable contributions, even for those choosing to use the new short form and its standard deduction.11 That kind of accommodation was critical, especially in the name of equity, they insisted. “It is utterly unfair to give a profligate spendthrift who seldom gives a penny to charity the same credit and tax deduction as the devout widow or the conscientious contributor who gives a tithe or sacrificially gives 15 percent or more, in order to share with those who are less fortunate,” the group declared.12

Lumping all possible deductions into a single standard deduction made for intolerable moral ambiguity. “The pastor and priest share in the deductions for the other man’s alimony deductions,” the council insisted. The end result was distinctly anti-American. “It savors of communism to make work simpler for the bookkeeper,” the council declared.13

That language was intemperate but not unusual. One Baptist attorney, serving as chair of the Northern Baptist Tax Vigilance Committee, chose a different epithet, labeling the standard deduction fascist. “When they knocked out the 15 per cent income tax exemption for church and charity under the guise of simplification, it was a fraud on church and charity,” said Romain Hassrick, a leader of the group. “It is the first long step down the road toward the destruction of religious freedom and toward federal subsidy and control of education and charity. That is fascism.”14

Calls for simplification rang hollow in the ears of many charity advocates. “There is no such thing as ‘simplification’ to the point of totalitarian regimentation, squeezing out the vital spark of personal freedom,” Hassrick wrote.15

That was strong language in defense of sweeping claims. But those arguments were buttressed by more prosaic calls for tax fairness. By treating a donor the same as a non-donor, the standard deduction imperiled the very nature of philanthropy itself. As one unhappy member of Congress said:

- It has been the basic policy in America that our tax program is one that considers a gift to the U.S.O., the Red Cross, a children’s home, a hospital, a home for the aged, a college, a mission, a church, or any other institution rendering service and mercy, an expenditure for the public good, and, therefore exempt from taxation.

The new deduction, by contrast, would abandon that policy, because “a heavy contributor has the same amount taken out of his wages or salary as one who contributes nothing.”17For most charities, however, the bottom line was still the bottom line. The standard deduction seemed likely to reduce the incentive to give, thereby further depressing contributions to charitable organizations.

Not everyone was convinced by those claims. Rep. Absalom Willis Robertson predicted that the absence of an itemized deduction (at least for those filing the new short form) would not affect giving.18

Similarly, House Ways and Means Committee Chair Robert Doughton maintained that most people donated money not for the tax savings, but to advance the work of worthwhile organizations. His Senate counterpart, Walter F. George, agreed. “The committee does not believe that it can be proved that a tax incentive has been an important factor” in the making of gifts by taxpayers of modest means, he said. And in any case, people who ended up contributing more than the standard deduction could choose to claim those deductions when filing a tax return in the spring. Finally, the bill actually increased the contributions eligible for deduction by those who continued to itemize; under existing law, those contributions were deductible up to 15 percent of net income, while under the proposed legislation, taxpayers could deduct up to 15 percent of adjusted gross income, George said.19

With the leadership unmoved, calls by charity lobbyists to rethink the standard deduction were doomed to failure. Congress approved the Revenue Act of 1944, and it won a quick signature from President Franklin D. Roosevelt. While acknowledging the importance of charities to the American social fabric, policymakers were won over by the prospect of “painless extraction” (at least for the 30 million Americans expected to use the new standard deduction).20

For their part, rank-and-file taxpayers seemed to agree with Congress, not charity lobbyists. In a December 1944 poll, respondents said that only people who actually made charitable contributions should be able to deduct them — a point that charities were certain to endorse. But 47 percent believed that the law still embodied that rule — which it did for everyone who still chose to itemize.21

But that wasn’t many people. In 1945 just under 17 percent of filers chose to itemize. That number declined somewhat in subsequent years, but the standard deduction generally performed as advertised, simplifying tax returns for a great many filers.22

And it did so without destroying charities. The popularity of the standard deduction did not pull the rug out from under nonprofit organizations, at least not in dollar terms. Evaluating the post-1944 data from the perspective of 1960, C. Harry Kahn concluded that “there is no evidence that the institution of the standard deduction had a repressive effect on the share of income devoted to philanthropy.”23

Of course, Kahn did not have the final word on the matter; debate still rages over the incentive effect of the charitable deduction. And charities, for their part, are inclined to play it safe, defending the deduction and insisting on its efficacy. But Camp’s proposal for a supersized standard deduction seems likely to reignite the debate between champions of simplification and defenders of the charitable sector.

1 Which is not to say that the standard deduction doesn’t create its own sort of complexity. See John R. Brooks, “Doing Too Much: The Standard Deduction and the Conflict Between Progressivity and Simplification,” Columbia Journal of Tax Law, June 23, 2011, at 203-246, at 206 passim.2 The historical analysis that follows is drawn from Joseph J. Thorndike, “Making the World Safe for Philanthropy: The Wartime Origins and Peacetime Development of the Tax Deduction for Charitable Giving,” a paper for the Urban Institute’s Tax Policy and Charities Project, Urban Institute, Apr. 2013.

3 On the wartime transformation of the income tax, see Joseph J. Thorndike, Their Fair Share: Taxing the Rich in the Age of FDR (Urban Institute Press, 2013), ch. 9.

4 Senate Finance Committee, “Revenue Act of 1941,” 77th Cong., 1st sess., Aug. 8, 11-15, 18-23, 1941, at 4.

5 Id.

6 Id. at 6.

7 “Tax-Exempt Bodies Ask Relief in Bill,” The New York Times, Dec. 5, 1943, at 1.

8 “‘Easy’ Tax Bill Moves Toward Senate Action,” The Christian Science Monitor, May 19, 1944.

9 Charles T. Clotfelter, Federal Tax Policy and Charitable Giving, National Bureau of Economic Research Monograph (Chicago: University of Chicago Press, 1985), at 32.

10 “Act to Aid Philanthropy,” The New York Times, Mar. 4, 1944, at 11.

11 “Tax Amendment Urged,” The New York Times, July 20, 1944, at 31.

12 Rev. John Evans, “Churches Seek Amendment to Income Tax Act,” Chicago Daily Tribune, July 31, 1944, at 18.

13 Id.

14 The Rev. John Evans, “Simplified Tax Called Fraud Upon Churches,” Chicago Daily Tribune, July 30, 1944, at 9.

15 Id.

16 Ellen P. Aprill, “Churches, Politics, and the Charitable Contribution Deduction,” Boston College Law Rev. 42 (2001), at 843-873, at 851.

17 “Simplified Taxes Debated in House,” The New York Times, May 4, 1944, p. 25.

18 See Aprill, supra note 16, at 851.

19 Id.

20 “‘Painless Extraction’ Tax Bill Passes Senate: Measure Would Excuse 30,000,000 From Having to Fill Out Individual Returns Yearly,” Los Angeles Times, May 21, 1944, at 3.

21 Postwar Problems, Income Tax, Dec. 1944. Retrieved from the iPOLL Databank, the Roper Center for Public Opinion Research, University of Conn.

22 Internal Revenue Service, Statistics of Income for 1945: Part 1 (GPO, 1951), at 5.

23 Kahn, “Philanthropic Contributions” in Personal Deductions in the Federal Income Tax (Princeton University Press, 1960), pp. 46-91 at 72. Kahn left open the possibility that the charitable deduction did increase donations among high-income taxpayers.