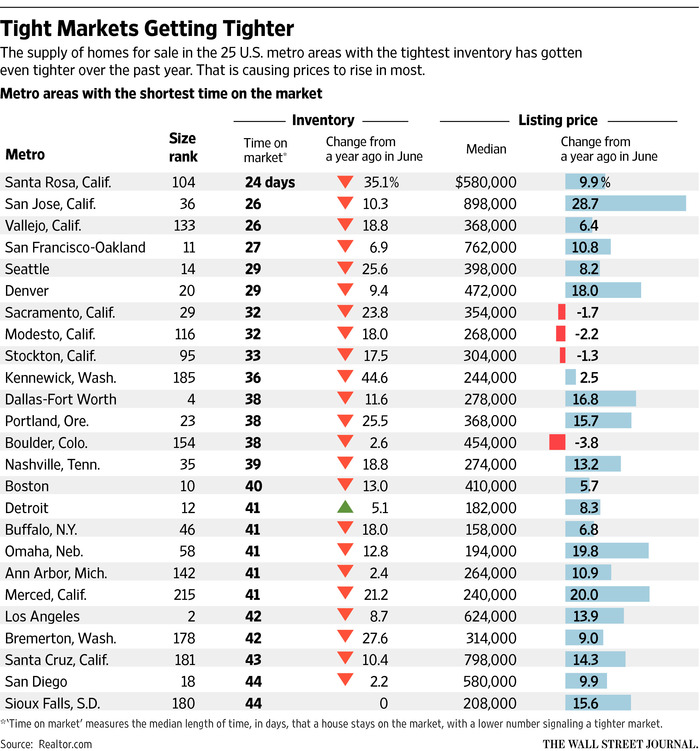

But in more than one-third of the 300 largest metropolitan areas tracked by Realtor.com, homes listed for sale in June had been on the market for a median of less than two months.

A low median figure indicates rapid turnover in inventory as demand for homes exceeds supply.ENLARGEThose include big markets like San Francisco, with a median time on market of 27 days, and Dallas at 38 days, as well as smaller markets like Vallejo, Calif., at 26 days and Kennewick, Wash., at 36 days.The tightest market in June was Santa Rosa, Calif., a relatively affordable Bay Area suburb, where the median time a home was on the market was 24 days.

In those markets with limited supply, bidding wars tend to push prices higher, creating price bubbles. According to Realtor.com, the $580,000 median listing price in Santa Rosa is up nearly 10% from a year ago. That handily outpaces the national average increase in resale prices, which the National Association of Realtors calculates at 7.9%. Realtor.com is operated by Move Inc., which like The Wall Street Journal is owned by News Corp.

The low supply of homes reflects a reluctance or inability of owners to sell their current house or apartment and trade up to their next, often larger, one. Some remain skittish about the economy, their own finances or their ability to qualify for a mortgage. Others can’t sell because they are underwater, meaning they owe more on their mortgages than the homes are worth.