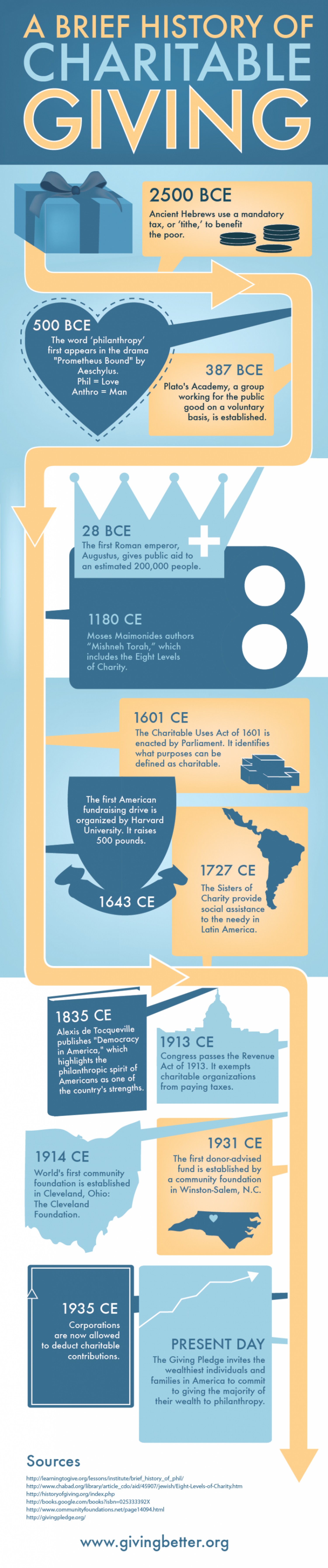

Tax History: The Love-Hate Relationship With the Standard Deduction

MARCH 27, 2014 Tax History: The Love-Hate Relationship With the Standard Deduction Joseph J. Thorndike If Dave Camp gets his way, the standard deduction is going to get a lot bigger. Apparently that is a good thing. “Right now, more than a third of all Americans are forced to itemize their deductions to ensure they […]

10 Mindsets That Will Radically Improve Your Performance | TIME

These mindsets allow openness and flexibility while also providing you precise direction Success is something all career-driven individuals desire yet it eludes many people — at least at the levels desired. Why are some businesspeople successful and others not? http://time.com/3739714/10-mindsets-that-will-radically-improve-your-performance/

Top 10 Reasons You Are Going To Be Audited This Year

by Jesse Campbell on March 18, 2013 No one wants to go through an audit from the IRS. It’s time consuming, stressful and could very well end with you paying steeps fines or even facing jail time. It’s also very unlikely to happen to you. In 2011, the IRS audited 1.6 million individual returns, which […]

Fewer Taxpayers Are Audited Amid IRS Budget Cuts – Wall St Journal

Fewer Taxpayers Are Audited Amid IRS Budget Cuts By LAURA SAUNDERS Associated Press Worried about a tax audit? The good news is that you’re far less likely to be chosen than you were a few years ago. The bad news is that the improved odds apply to tax cheats, too. The Internal Revenue Service audited […]

IRS Audit Red Flags-Claiming Rental Losses – Kiplinger

Claiming Rental Losses Normally, the passive loss rules prevent the deduction of rental real estate losses. But there are two important exceptions. If you actively participate in the renting of your property, you can deduct up to $25,000 of loss against your other income. But this $25,000 allowance phases out as adjusted gross income exceeds […]

Rental Property Deductions You Can Take at Tax Time

Rental Property Deductions You Can Take at Tax Time (Turbo Tax) OVERVIEW Rental property often offers larger deductions and tax benefits than most investments. Many of these are overlooked by landlords at tax time. This can make a difference in making a profit or losing money on your real estate venture. If you own a […]

Tax Pro or Tax Software: How to Make the Right Choice – daveramsey.com

Tax Pro or Tax Software: How to Make the Right Choice Happy New Year and welcome to 2015! Are you ready to get going on the new year and your new money goals? If not, we can certainly help you get started on one of your first financial tasks: filing your income taxes. It’s never […]

What’s the difference between an individual retirement account (IRA) and an annuity?

Individual Retirement Accounts (IRAs) and annuities both provide the opportunity to grow money on a tax-deferred basis, but there are differences between the two. An IRA can be thought of as an individual savings account with tax benefits. You open an IRA for yourself (that’s why it’s called an individual retirement account) and if you […]

See How Your Tax Dollars Are Spent – Online Calculator from the White House

American taxpayers are now able to go online and see exactly how their federal tax dollars are spent. Just enter a few pieces of information, and the Taxpayer Receipt gives you a breakdown of how your tax dollars are spent on priorities like education, veterans benefits, or health care.