By Matt Phillips @MatthewPhillips

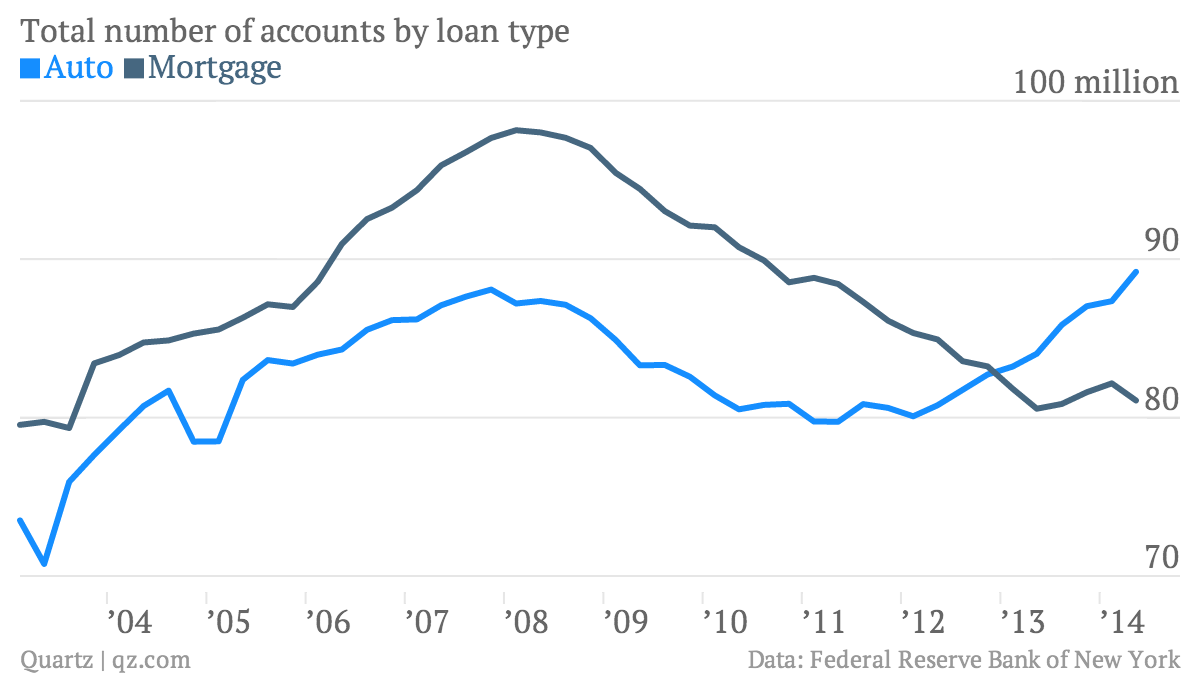

This Federal Reserve Bank of New York data elegantly explicates the last decade of American economic life.

The lax lending standards of the housing mania sent the number of US home mortgages up to nearly 100 million in early 2008. More recently the lax lending standards of the US subprime auto market have been driving a boom in car loans. (Banks that cottoned on to the trend early, such as Wells Fargo, have made a ton of cash.)

The surge of auto lending pushed the number of US car loans above the number of US mortgages in early 2013, a turnabout from the status quo over the previous decade.

What’s the takeaway? US consumption, like consumption in most advanced economies, is tightly linked to credit availability.

In the wake of the US housing bust, mortgage lenders, understandably, became extremely cautious on loans. They remain so, and the US housing market remains weak. Auto lenders, on the other hand, have gotten aggressively permissive about lending. The result? US auto sales have made a huge recovery.

via The utter transformation of US finance, told in one chart – Quartz.