A new survey says that younger workers and other renters aren’t turning away from homeownership because they lack the desire to own homes. Instead, they’re staying on the sidelines because they lack the capacity to purchase.

The analysis from the New York Federal Reserve Bank comes via their survey of consumer expectations in February. It polled 867 homeowners and 344 renters on their attitudes toward homeownership and their plans to move.

One popular trend cited frequently in the press is that millennials and other renters have permanently turned away from owning homes after watching their parents’ generation take it on the chin during the housing bust. How else to explain the fact that home buying has remained soft despite the fact that homeownership has rarely been more affordable, given low interest rates and the recent home-price crash.

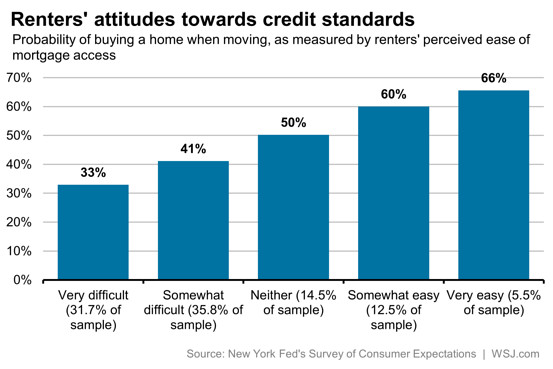

But the New York Fed researchers say their survey points to a different conclusion: borrowers want to buy, but they can’t cut it financially. Conservative mortgage lending standards are only likely to exacerbate this problem.

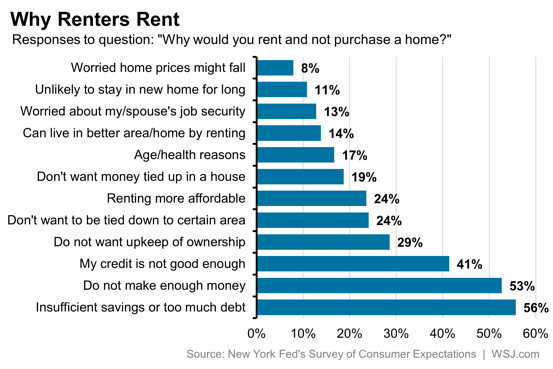

Their summary offers three takeaways. First, a majority of renters opt against owning because their incomes or savings are too low, or their debts too high, to handle homeownership. Around 40%, moreover, say their credit isn’t good enough.

“Weak fundamentals and limited access to credit, rather than a lack of desire to own, are preventing renters from buying,” write Andreas Fuster, Basit Zafar and Matthew Cocci in a blog post examining their findings.

via Why More Renters Aren’t Buying (Hint: Weak Incomes, Savings) – Real Time Economics – WSJ.