Foreclosure numbers dip in Spokane, remain historically high

Housing recovery said to hinge on job growth

Mike McLean January 15th, 2015

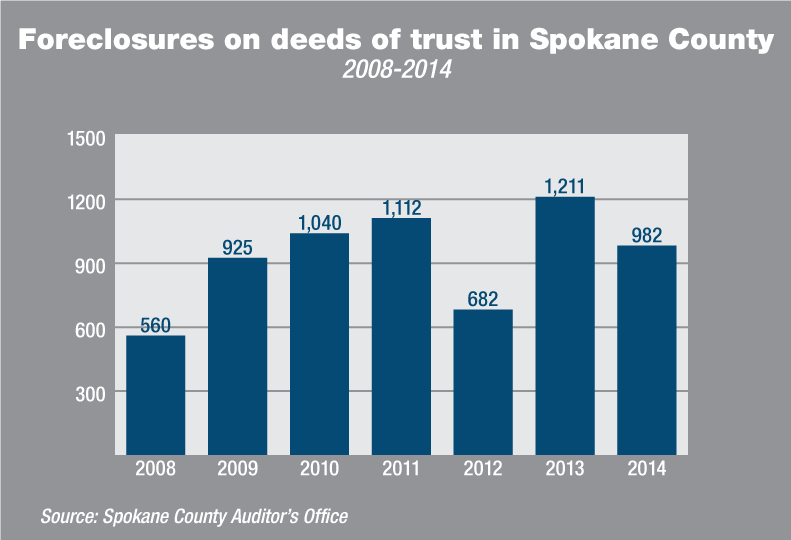

Foreclosure actions completed in 2014 in Spokane County fell 19 percent compared with the record number of foreclosures in 2013, but they’re still historically high, some housing-market observers here say.

The Spokane County Auditor’s Office recorded 982 foreclosures on deeds of trust last year, down from a peak of 1,211 a year earlier, but still higher than the years leading up to the Great Recession. A deed of trust is a pledge of real property that secures a mortgage.

Phil Kuharski, a longtime Spokane economic data analyst and active member of the Spokane-Kootenai Real Estate Research Committee, says the economy continues to struggle from the effects of the mortgage crisis that coincided with the recession.

“The housing-stock situation is still under some stress because underlying economics continue to drag along,” Kuharski says.

Foreclosures might drop some more this year, but likely will stay at historically high levels unless job growth quickens, he says.

“It’s all dependent on jobs and the quality of jobs in the community,” he says. “That’s the leading domino in the effects of the foreclosure situation.”

Kuharski says employment data indicate job growth will be “tortuously slow” in the near future.

“The ability of the old-fashioned nuclear family to take on a cute little bungalow with white picket fence has been impacted dramatically,” he says. “We now have a have high number of young people living in mom and dad’s basement.”

Grant Forsyth, chief economist for Spokane-based Avista Corp., says foreclosure rates are one of the factors he tracks among other variables, including existing home prices and building permit numbers, to get a sense of the health of the housing market.

“It’s hard to know the extent that foreclosures reflect the current state of the economy,” Forsyth says. “Foreclosures might reflect the past, and perhaps they’re not indicative of the way things look today.”

He contends the housing market is in a recovery period, adding, “It’s just that the housing downturn was severe, and we’re still dealing with the overhang from that event.”

Rob Higgins, executive vice president of the Spokane Association of Realtors, says the overall market for single-family homes here is trending upward, despite lingering foreclosure actions.

The total number of homes sold through the association’s Multiple Listing Service in 2014 was 5,820, up 5.6 percent from 5,510 homes sold in 2013.

While most housing-market indicators have been moving in a positive direction since the Great Recession, lingering foreclosure actions may be weighing down overall market prices, he says.

The median price for homes sold through the Spokane MLS in 2014 was $168,000, an increase of 2 percent compared with 2013.

“Distressed-property sales continued to go down, but still made up almost 17 percent of all sales last year,” he says. “It was almost 19 percent the year before.”

Distressed properties include foreclosed, bank-owned, and short-sale properties for sale under urgent conditions, usually at below-market value.

Bank-owned properties, for instance, sold for an average price of around $100,000, Higgins says.

“That’s got to be having some impact,” he says, referring to the slow growth in median selling prices in the overall housing market.

In Kootenai County, foreclosure actions have declined consistently the last few years, although the total foreclosure number still is higher than prerecession levels, according to data compiled for the fall 2014 Real Estate Report, a semiannual publication of the Spokane-Kootenai Real Estate Research Committee.

For the first nine months of 2014, 633 foreclosure actions were filed in Kootenai County, and the report projects 844 foreclosure actions for the full year, down from 1,154 actions a year earlier. Foreclosure actions in Kootenai County peaked at 2,903 in 2010.

Kootenai County’s foreclosure activity is reported differently and isn’t directly comparable to Spokane County’s foreclosures, because not all of the actions reported in Kootenai County result in foreclosures on deeds of trust.

Spokane-area foreclosure rates still are below the national rates, Forsyth says.

CoreLogic, a California-based real estate data service, recently reported that the foreclosure rate in the Spokane area was 1.4 percent as of September and trending down from 1.9 percent a year earlier, which is on par with foreclosure rates for all of Washington state.

The report showed the nationwide foreclosure rate was 1.6 percent, down from 2.3 percent a year earlier.

via Foreclosure numbers dip in Spokane, remain historically high > Spokane Journal of Business.